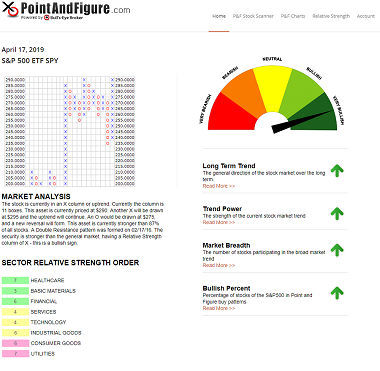

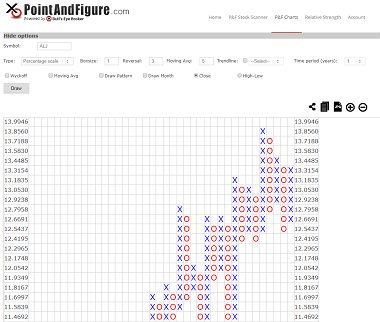

Point and Figure Charts: More Insight in Less Time

Get Instant Results with our services, and Beat The Market!

Yes, You can beat the market with our Professional Advisory Services. Pin-point the exact time to buy and sell, and know what to trade. We offer P&F Charts, Stock Picks, Relative Strength Analysis and Market Timing.

We make you a better trader with our tools, training and services. We provide the Point and Figure trading strategy with online P&F charts and Relative Strength analysis. Along with market timing indicators that are proven to beat the market. You can do it yourself, or let us do it for you.

We will give you a filtered list of the best stocks, in the best sectors and pinpoint the best time to be buying and selling. This lets you trade without stress or effort - And lets you beat the market!

Sign up right now to get free access, and you will be trading successfully already today.

GET STARTED FOR FREE, RIGHT NOW

We will not share your email. Read our privacy policy and terms of service.